Wildfire Insurance Claims & Protection in Saskatchewan

Wildfires can devastate homes and communities, leaving homeowners to navigate the complex process of insurance claims. As these natural disasters become more frequent, understanding your wildfire insurance coverage is crucial.

The escalating crisis in northern Saskatchewan, where over 5,500 people have been evacuated from communities, including Pelican Narrows and Denare Beach, has put tremendous pressure on the insurance industry in 2025.

The Wildfire Situation in Saskatchewan

“We have not seen a fire season with as much impact and activity in the last couple of decades,” said Steve Roberts, vice-president of operations for the Saskatchewan Public Safety Agency (SPSA).

The 2025 wildfire season was a wake-up call for the province. By the end of the year, the SPSA confirmed that over 600 fires had burned through roughly 1.5 million hectares. This level of activity has fundamentally changed how we look at fire protection.

As we move through February 2026, the province is using this winter window to prepare for the possibility of another dry spring and an early start to the next fire cycle.

2024 vs. 2025 Provincial Wildfire Comparison

“The fires are so big, and they’re so hot that we’re not actually putting them out. We’re just trying to steer them,” notes a recent report on modern wildfire suppression strategies. The reality is that fire services are often forced to move from a strategy of dousing flames to one of containment and protecting critical infrastructure.

This shift in strategy explains why some areas, like East Trout Lake, saw such “substantial loss” last year. When fires reach a certain intensity, crews often cannot safely get in front of the flames to save every individual structure. Instead, they focus on steering the fire away from entire towns or essential power and water systems.

“We used to douse wildfires, now we’re just trying to contain them,” experts explain in Canadian Underwriter. For property owners, this means the old assumption that a fire truck will always be able to save your home is no longer a guarantee in extreme conditions.

With 2025 officially being one of the most expensive years for natural disasters in Saskatchewan, it is clear that the “new normal” involves larger, more aggressive fires.

Understanding this change in how fires are fought helps highlight why we talk so much about FireSmart strategies. Since you can’t always count on a fire being “put out” before it reaches your area, taking steps to make your property less flammable is your best line of defence.

Understanding Your Wildfire Coverage

If you live in an area where wildfires are a threat, you need to know exactly what your policy covers. The good news is that most home and business insurance policies cover fire damage, including wildfires. Just remember: stay away from your property until local officials officially say it is safe to go back.

What is Covered?

Standard insurance for your main home or your seasonal cabin usually covers fire damage. This doesn’t just apply to the house itself; it typically includes other buildings on your property and your personal belongings inside them.

It’s also good to know that “comprehensive” Saskatchewan auto insurance covers your vehicle for fire damage. If your car is registered in Saskatchewan, your basic plate insurance will help with repair costs, though you’ll have to pay a $700 deductible.

If you have a Saskatchewan Auto Pak, your coverage is even better. It covers repairs from wildfires or lightning, and you won’t have to pay a deductible at all.

Know Your Limits

Take a quick look at your policy limits to make sure they cover the actual cost to rebuild your home and replace everything in it. If you are forced to leave because of a mandatory evacuation, ask about Mass Evacuation coverage. This is a huge help because it pays for things like hotels, food, and gas while you’re displaced.

Insurance companies have different rules for this, so ask your advisor to explain how your specific policy works. The amount of time this coverage lasts can also vary, so be sure to check the details with your adjuster when you file a claim.

What Isn’t Covered?

Every policy has things it won’t cover; these are called exclusions. For example, some policies won’t pay for damage caused by the ground moving, like a landslide or mudslide that happens after a fire. Knowing these details now can prevent a lot of stress later.

Remember, every insurance company is a bit different. Your coverage might not look exactly like your neighbour’s. Talk to your broker so you know exactly what your specific policy does and doesn’t do.

How to Document Your Losses

To make the claims process go as smoothly as possible, you need to keep good records. This documentation is the proof your insurance company needs to make sure you get a fair payout for everything you’ve lost.

Make a Home Inventory

Having a list of everything you own is a lifesaver when you’re filing a claim. It’s much easier to make this list before an emergency, since it’s hard to remember every little thing after a fire.

- List your belongings in a spreadsheet or use a home inventory app. Taking photos or a video walk-through of your house is also a great idea.

- Note down what each item is, how many you have, and roughly what they cost or how old they are.

- Keep this list somewhere safe online or at a friend’s house so you can get to it easily.

Try to update your list once a year or whenever you buy something expensive.

Save Your Receipts

You’ll want to keep track of every dollar you spend because of the fire:

- Save all receipts for cleaning and for your temporary living costs, such as hotels and meals.

- If you have old receipts or bank statements for things that were destroyed, gather those up too.

- For expensive items like jewelry or electronics, appraisals or receipts are very helpful.

Don’t panic if you don’t have a perfect record of everything. Insurance companies know that documents get lost in fires. Your adjuster will give you the forms you need. The goal is just to provide as much info as you can to help them settle your claim fairly.

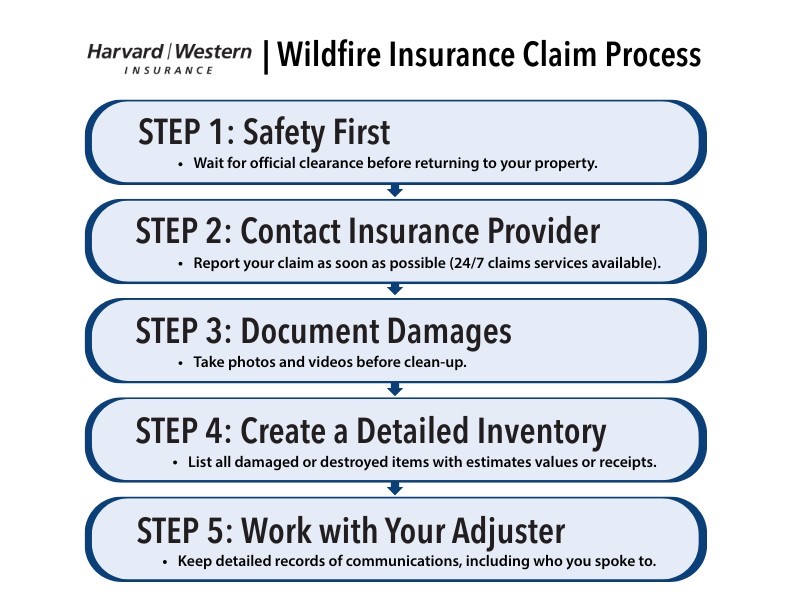

How to File Your Claim

Talk to Your Broker

The first thing you should do when you’re ready to file a claim is call your insurance broker. Most companies have 24-hour claims lines, so you can get the ball rolling right away.

When you call, give them as much detail as you can about what happened. If you can’t live in your home right now, ask about “Additional Living Expenses” (ALE). This part of your policy helps pay for things like temporary housing or even laundry costs if your rental doesn’t have a washer and dryer.

Ask if your specific insurance company has its own resources. For example, Wawanesa Insurance has a claims guide made specifically for wildfires and evacuations.

When a fire is active, your safety is the only thing that matters. Please follow the instructions from local authorities and leave immediately if you are told to evacuate. These experts are making calls based on the best info available.

Once the danger has passed, wait for the official “all clear” before heading back. Going back too soon can be dangerous for you and for the crews still working in the area.

How to Protect Your Property

Resources from FireSmart™ Canada

If you haven’t yet, check out FireSmart Canada. They have great programs designed to help neighbourhoods become more resilient to wildfires.

- They offer a free one-hour course called FireSmart 101 that’s full of practical tips for protecting your home.

What are the best ways to:

1. Lower your wildfire risk?

You can make a big difference by clearing away flammable plants near your house, thinning out tree branches so fire can’t jump between them, and getting rid of any dead wood or piles of leaves.

According to experts at Canadian Underwriter, the most effective thing you can do is focus on the first 1.5 meters (5 feet) directly around your home. Most houses aren’t actually lost to a massive wall of flames, they are destroyed by flying embers that land on something flammable right next to the house.

By keeping this “non-combustible zone” clear of mulch, dead leaves, and woody plants, you significantly increase the chances of your home surviving a fire.

2. Preparing for a possible evacuation?

Your Evacuation Checklist:

- Make sure your house number is easy to see from the road.

- Move things like firewood or propane tanks at least 30 feet away from your house and any sheds. Nothing flammable should be touching your siding, deck, or porch.

- Keep your grass cut short (under 10 cm) to slow down approaching flames. Try to clear a “safety zone” by raking away mulch or dead leaves within five feet of your home.

Stay Connected With Harvard Western

Thanks for reading our article; I hope you enjoyed this month’s wildfire insurance claims topic. Here are some more ways to access more insurance information and tips:

Visit our Blog/article page each month, where we publish various insurance articles and share information on specific industry products.

Learn more about Claims and visit our support page for comprehensive information.

Follow us on LinkedIn to stay up to date on our latest company updates.

Posted in Home & Tenant on May 29, 2025 by Hope Prost