Photographer Equipment Insurance: Coverage Options

In the world of photography, where your camera and equipment are not just tools but extensions of your creativity, it’s essential to ensure they are protected. Photographer insurance is more than just a safety net; it’s a critical investment in safeguarding your professional assets and financial future in a field where risk is a constant companion.

With the right photographer equipment insurance, you can shield yourself from unexpected financial burdens that may arise due to theft, damage, or loss of your precious gear. Understanding the importance and nuances of this specialized insurance can make a significant difference in how you manage your business and protect your livelihood.

Why Photography Gear Insurance is Essential

Understanding the Risks

Photographers often find themselves in diverse environments, capturing moments that require them to carry valuable equipment. Whether it’s a beach wedding or a rugged mountain shoot, the risk of damaging your gear is always present. Imagine the financial strain if you couldn’t replace a damaged lens or camera before your next gig. Photographer equipment insurance is crucial as it covers the unexpected costs of repairing or replacing your gear, ensuring you can continue working without interruption.

Case Studies of Photography Equipment Accidents

Accidents can happen to anyone, even the most careful photographers. Consider the case where equipment was damaged during a shoot at a historical property, leading to substantial financial claims for damages and injuries caused by an unsecured wire. In another instance, a photographer’s camera fell down a flight of stairs, a costly mistake that was fortunately covered by their insurance. These real-life examples underscore the importance of having robust photography gear insurance, which not only protects your equipment but also safeguards your financial stability in the face of accidents.

Types of Photography Insurance

Equipment Insurance

Photography equipment insurance is crucial for anyone using their camera gear professionally or as a hobby. This type of insurance covers replacing or repairing your equipment if it’s stolen or suffers sudden and accidental damage. For instance, camera equipment insurance might cover everything from your camera body to lenses and lighting equipment, protecting you against theft, fire, or accidental damage.

Liability Insurance

Liability insurance is essential for protecting against lawsuit claims of property damage or bodily injury you might cause while conducting your photography business. This coverage is crucial if your equipment causes harm, perhaps by falling and injuring someone during a shoot. General liability insurance does not cover your equipment but protects against third-party claims, which can be vital in safeguarding your financial stability.

Errors and Omissions Insurance

Errors and Omissions Insurance, or Professional Liability Insurance, is tailored specifically for situations where a client claims dissatisfaction with your professional services and decides to sue. This could cover legal expenses arising from alleged negligence or failure to deliver promised services. For example, if a missed deadline for photo delivery leads to a client’s financial loss, this insurance can cover the consequential costs. This type of insurance is particularly important as it addresses the professional risks associated with delivering your photographic services, offering peace of mind and financial protection against claims of professional errors or omissions.

How to Choose the Right Photography Insurance

Evaluating Coverage Options

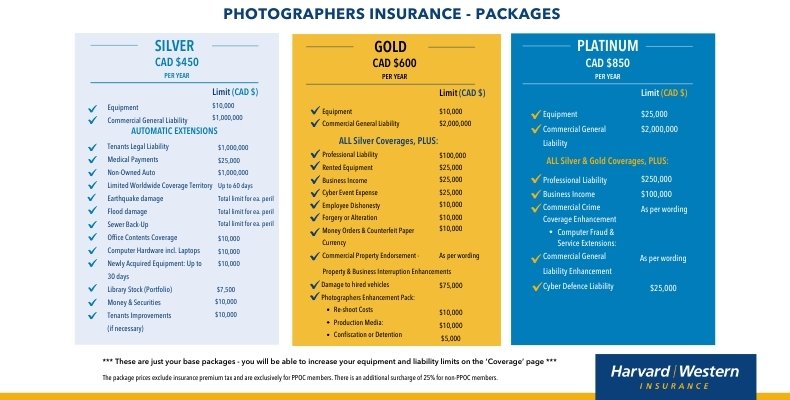

When selecting the right photography insurance, it’s crucial to understand the different types of coverage available. General liability insurance is essential to protect against third-party bodily injury or property damage claims. For equipment-specific concerns, camera and equipment insurance covers theft, damage, or loss of your photography gear. Professional liability insurance, also known as errors and omissions insurance, is advisable for protection against claims of negligence or failure to deliver promised services.

Considering Deductibles and Premiums

The cost of photography insurance can vary significantly, and it’s important to consider both the deductibles and the premiums. Deductibles are what you pay out of pocket before your insurance coverage kicks in. For example, if your deductible is $500 and you incur $1000 in damages, you will pay the first $500, and your insurance will cover the remaining $500. Premiums are the regular payments made to keep the insurance policy active. These can range from monthly to annual payments and will depend on the coverage limits and the insurer’s assessment of your risk level.

Reading Policy Details

Carefully reading the policy details is paramount in choosing the right photography insurance. Ensure that the policy covers all the necessary aspects of your photography practice. This includes checking for any exclusions that might affect claims related to your photography equipment or activities. It’s also wise to confirm whether the policy includes international coverage if you travel abroad for shoots.

Tips for Making a Claim on Your Photography Insurance

Documenting Your Equipment

It’s essential to maintain a detailed inventory of your camera equipment. Start by laying out all your gear, such as camera bodies, lenses, and accessories, and photograph each item. Create an electronic record, preferably in a spreadsheet, noting each piece’s serial number, purchase date, and cost. Store this information and digital copies of purchase receipts in a secure location.

Filing the Claim Promptly

When you experience loss or damage, contact your insurance provider immediately. Provide a detailed description of the incident and the affected equipment. Your insurance advisor will guide you through the claims process, ensuring you submit all necessary documentation swiftly. This prompt action facilitates a smoother claims process and helps in quicker resolution and reimbursement.

Understanding the Claims Process

Understanding what is covered and, importantly, what is not can significantly affect the outcome of your claim. Review your policy to know the exclusions and coverage limits. In case of a claim, be prepared to provide proof of ownership and any relevant evidence, such as a police report in case of theft. Remember, the deductible amount will influence the actual reimbursement from the insurance company. If the cost of the loss is less than the deductible, you might choose not to proceed with the claim to avoid potential rate increases.

Reflecting on the diverse insurance types available, from equipment to liability to errors and omissions insurance, the key takeaway is the importance of selecting a policy that complements the unique needs of your photography practice. As we’ve unpacked the how-tos of choosing insurance and the steps for making a claim, it’s evident that being prepared can significantly ease potential stresses.

So, as you move forward, let this guide be the cornerstone upon which you build a safer, more resilient photography career—one where your creativity knows no bounds, protected from the unpredictable tides of chance and circumstance.

Thanks for reading our article; I hope you enjoyed this month’s topic on photography gear insurance coverage. Here are some more ways to access more insurance information and tips:

- Visit our Blog/article page each month, where we publish various insurance articles and share information on specific industry products:

→ To learn more about or get a quote for Photographer Insurance, visit our PRODUCT PAGE

2. Follow us on LinkedIn to stay up to date on the latest business insurance articles and follow our company updates:

Posted in Business on November 18, 2022 by Hope Prost