Car Insurance Estimator: Your Complete Guide to Auto Pak

Table of Contents

Understanding Your SGI Coverage Options

Did you know that more than half of licensed Saskatchewan residents don’t have additional coverage beyond their basic plate insurance?

Did you know that more than half of licensed Saskatchewan residents don’t have additional coverage beyond their basic plate insurance? And that $200,000 liability limit on your license plates was set back in 1985, which is only worth about $88,000 in today’s dollars when adjusted for inflation.

Considering 90% of adults drive and Canadians experience an average of five accidents throughout their lifetime, car accidents are actually more common than house fires. In fact, they’re the leading cause of trauma and death for people under 45 years old.

Let’s explore your Auto insurance options to make sure you’re properly protected.

What is Basic Plate Registration Coverage?

Basic Plate Registration Coverage is the minimum required insurance that comes with your Saskatchewan license plates. It provides a foundation of protection, but has significant limitations you should understand.

Q: What protection does Basic Plate Registration include?

A: Your basic license plate insurance includes:

- $700 deductible (the amount you pay before insurance kicks in)

- $200,000 in third-party liability coverage

- Settlement based on the actual cash value (depreciated value) of your vehicle

- No-fault coverage (unless you choose to opt out)

- Up to 90% of net income replacement to a maximum of $102,673 if you’re injured

- Death benefits of 45% of the deceased’s net income, plus 5% for each dependent under 21

- Education allowance of up to $49,928 for the training of a dependent spouse

- Funeral expense coverage of $10,887

Q: What’s NOT covered by Basic Plate Registration?

A: Basic plate insurance does NOT include:

- Family security protection (for accidents with uninsured drivers)

- Coverage for your unlicensed vehicle while in storage

- Damage to vehicles you don’t own (like rentals)

- Loss of use coverage (rental car costs while yours is being repaired)

- Replacement value for new vehicles

- The ability to lower your $700 deductible

Q: Is Basic Plate Registration enough protection?

A: For many Saskatchewan drivers, basic plate insurance isn’t enough protection. The $200,000 liability limit was set in 1985 and hasn’t kept pace with inflation or rising costs. Consider that a serious accident involving multiple vehicles or injuries could easily exceed this limit, leaving you personally responsible for the difference.

What is an SGI Auto Pak Policy?

An SGI Auto Pak is additional insurance coverage you can purchase to enhance your basic plate insurance protection. It fills important coverage gaps and provides greater financial security for Saskatchewan drivers.

Q: What additional protection does an Auto Pak provide?

A: An Auto Pak policy offers:

- Increased third-party liability limits from $1 million up to $5 million

- Family security coverage at no additional cost (protects you if hit by an uninsured driver)

- Coverage for damage to vehicles you don’t own (like rental cars)

- Protection for your unlicensed vehicle or trailer while in storage

- Options to lower your deductible (as low as $50)

- Lower Road Hazard Glass deductibles for windshield damage

- Replacement or Repair Cost coverage for new vehicles (up to 60 months from delivery)

- Loss-of-use coverage (pays for a rental while your car is being repaired)

Q: How does Auto Pak enhance accident benefits?

A: Auto Pak provides enhanced accident benefits:

- Covers an additional 10% of net income (for 100% coverage vs. 90% with basic)

- Increased death benefits (50% of deceased’s net income plus additional amounts for dependents)

- Education allowance up to 50% above basic auto insurance

- Death benefit payments up to 50% above basic auto insurance

Q: Who should consider an Auto Pak policy?

A: You should consider an Auto Pak if you:

- Own a newer vehicle that would be expensive to replace

- Frequently rent vehicles

- Want peace of mind from higher liability limits

- Have significant assets to protect

- Drive in high-traffic areas or across provincial/international borders

- Want to minimize out-of-pocket expenses in case of an accident

How Much Does Auto Insurance Cost?

The cost of auto insurance varies based on several factors, including whether you have basic coverage only or add an Auto Pak policy.

Q: What factors affect my insurance rates?

A: Your auto insurance costs are influenced by:

- Your driving record and claims history

- Where you live in Saskatchewan

- Your coverage options and limits

- Your deductible choices

- Whether you use your vehicle for business purposes

Q: How can I get an accurate estimate of my Auto Pak costs?

A: The most accurate way to estimate your Auto Pak costs is to:

- Gather your vehicle information (plate number)

- Determine your desired liability limits ($1M to $5M)

- Decide on your preferred deductible amount

- Consider if you need special coverage like replacement cost

- Contact us for a personalized quote

Q: Are there ways to lower my car insurance costs?

A: Yes, you can potentially lower your car insurance costs by:

- Maintaining a clean driving record

- Bundling multiple vehicles on one policy

- Choosing a higher deductible (if you can afford it in case of a claim)

- Reviewing your coverage annually to ensure it still meets your needs

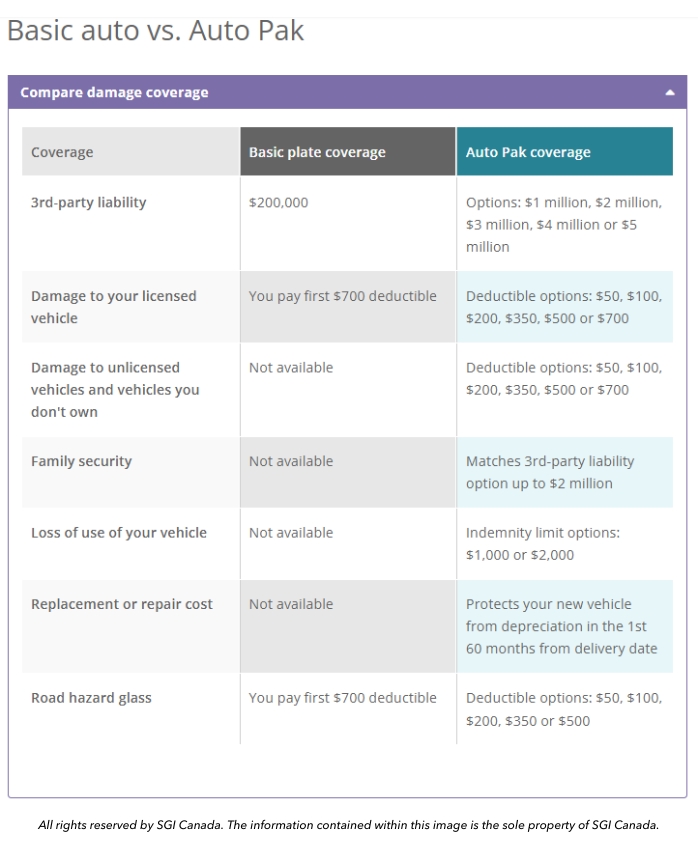

Comparing Basic Coverage vs. Auto Pak Benefits

When deciding between basic coverage and adding an Auto Pak, it helps to see a direct comparison of benefits.

Here’s a detailed comparison table:

| Coverage Feature | Basic Plate Insurance | Auto Pak Policy |

|---|---|---|

| Deductible | $700 fixed | As low as $50 (your choice) |

| Third-party liability | $200,000 | Up to $5 million |

| Income replacement | Up to 90% of net income | 100% of net income |

| Death benefits | 45% of income plus 5% per dependent | 50% of income plus additional amounts for dependents |

| Family security | Not covered | Included |

| Damage to non-owned vehicles | Not covered | Covered |

| Unlicensed vehicle storage | Not covered | Covered |

| Loss of use (rental) | Not covered | Covered |

| Replacement cost for new vehicles | Not covered | Available up to 60 months |

| Lower glass deductible | Not available | Available |

How to Estimate Your Car Insurance Needs

Determining the right amount of car insurance coverage requires evaluating your personal situation and risk factors.

Q: How do I know how much liability coverage I need?

A: To estimate your liability needs:

- Consider your assets that could be at risk in a lawsuit

- Think about where you drive (urban areas have higher accident risks)

- Factor in if you regularly drive across provincial borders

- Evaluate if you often have passengers in your vehicle

Most insurance professionals recommend at least $1-2 million in liability coverage for adequate protection in today’s environment.

Q: Should I choose a lower deductible?

A: When deciding on your deductible:

- Assess your emergency savings and ability to pay the deductible amount

- Calculate the premium difference between deductible options

- Consider your driving habits and accident likelihood

- Factor in the age and value of your vehicle

For newer or more valuable vehicles, a lower deductible often makes sense. For older vehicles, a higher deductible might be more cost-effective.

Q: Do I need replacement cost coverage?

A: Consider replacement cost coverage if:

- Your vehicle is less than 5 years old

- You have a loan or lease on your vehicle

- You couldn’t easily afford to replace your vehicle

- You want to avoid depreciation affecting your claim settlement

For newer vehicles, replacement cost coverage can protect you from significant depreciation, especially in the first few years of ownership.

When Do You Need More Than Basic Coverage?

While basic plate insurance provides minimum protection, many situations call for the enhanced coverage of an Auto Pak policy.

Q: When is basic plate insurance not enough?

A: Basic coverage is likely insufficient if you:

- Own a newer or more expensive vehicle

- Frequently drive in high-traffic areas

- Have a loan or lease on your vehicle

- Often rent vehicles or drive others’ cars

- Cross provincial or international borders

Q: Are there specific scenarios where an Auto Pak is essential?

A: An Auto Pak becomes particularly valuable in these scenarios:

- You cause a serious accident with multiple injured people (liability limits)

- Your new vehicle is totalled (replacement cost coverage)

- You’re hit by an uninsured driver (family security coverage)

- Your vehicle is in the repair shop after an accident (loss of use coverage)

- You damage a rental car (damage to non-owned vehicles coverage)

- Your seasonal vehicle is damaged while in storage (unlicensed vehicle coverage)

Frequently Asked Questions

Q: Can I add an Auto Pak at any time, or only when I renew my plate registration?

A: You can add an Auto Pak policy at any time, not just at renewal. Contact us to set up additional coverage whenever you need it.

Q: If I have an Auto Pak, do I still need the basic plate insurance?

A: Yes, Auto Pak supplements but doesn’t replace your basic plate insurance. For your vehicle to be on the road, you must maintain a valid basic plate registration.

Q: How do I make a claim if I have both basic coverage and an Auto Pak?

A: For most claims, you’ll start by reporting to SGI’s basic auto claims. If your claim involves coverage from your Auto Pak, the claims process will incorporate both policies as needed.

Q: Can I get an Auto Pak if I have a less-than-perfect driving record?

A: Yes, drivers with less-than-perfect records can still obtain Auto Pak coverage, though your rates may be affected by your driving history.

Q: Does an Auto Pak cover other drivers who use my vehicle?

A: Yes, your Auto Pak typically covers other drivers who use your vehicle with your permission. However, it’s important to disclose all regular drivers in your household when purchasing coverage.

Q: If I drive out of province, is my Auto coverage still valid?

A: Yes, your Auto coverage remains valid when driving elsewhere in Canada and the United States (not Mexico). However, having an Auto Pak with higher liability limits is strongly recommended for out-of-province travel.

Last Updated: July 11, 2025

This guide is for informational purposes only. For personalized advice and accurate quotes, please contact our office to speak to an insurance professional. Insurance coverage details and options may change over time.

Thanks for reading our article; I hope you enjoyed this month’s car insurance topic. Here are some more ways to access more insurance information and tips:

- Visit our Blog/article page each month, where we publish various insurance articles and share information on specific industry products:

→ Learn more about Auto Insurance and visit our PRODUCT PAGE

2. Follow us on LinkedIn to stay up to date on the latest business insurance articles and follow our company updates:

Posted in Auto on February 25, 2022 by Hope Prost