Crop Insurance Payouts on the Rise Due to Climate Change

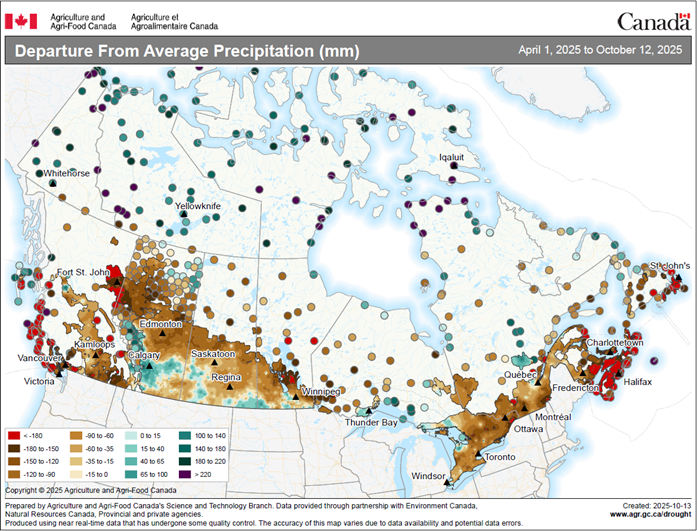

Ever notice how the weather just doesn’t seem to cooperate anymore? Scorching droughts shrivel crops, while downpours turn fields into mud baths. These weather extremes, once outliers, are becoming the norm, wreaking havoc as Canadian farm insurance companies are facing a tough reality: crop insurance payouts are skyrocketing.

Farm insurance, the financial safety net meant to protect farmers from bad weather and pests, is straining under the weight of climate change.

Table of Contents

Rising Costs, Rising Concerns

A recent report by the Canadian Broadcasting Corporation (CBC) highlights a concerning trend: crop insurance payouts in Canada are on the rise. Crop insurance is a financial safety net for farmers, protecting them from losses due to weather events, pests, and diseases.

However, the increasing frequency and intensity of extreme weather events linked to climate change are straining these programs.

Financial Strain in Saskatchewan

Recent provincial budget data confirms that the cost of stabilizing the agricultural sector remains high. Despite better yields in 2025, the underlying volatility caused by “weather whiplash”, shifting from extreme dry to extreme wet, has kept provincial crop insurance liabilities at the forefront of fiscal planning.

“We are going to see more droughts, more pests, the yields won’t be as good. For me, the question is, who should pay for that? I do foresee that the government will be solicited more and more.”

Final 2025 Production & Payout Realities

According to the final 2025 data from Statistics Canada, Canadian farmers saw a significant rebound in production for major field crops, but the results were heavily divided by geography. While timely late-season rain saved many Western crops, Eastern Canada struggled with heat and dry spells.

2025 Harvest Highlights:

Tonnes of wheat produced a new national record, led by an 11.2% year-over-year increase.

An increase in canola production, reaching a record 21.8 million tonnes nationwide.

However, these record highs don’t tell the whole story for insurance. In Saskatchewan, while wheat yields rose 10.9%, the harvested area actually fell by 4.3%. Meanwhile, Ontario and Quebec saw corn and soybean production drop significantly as summer heat took a toll.

Saskatchewan Crop Production Trends (2025 Final Estimates)

| Crop Type | 2025 Production (Tonnes) | % Change from 2024 |

|---|---|---|

| Total Wheat | 18.2 Million | +6.1% |

| Canola | 12.2 Million | +16.7% |

| Wheat Yield | 49.7 bu/ac | +10.9% |

| Canola Yield | 44.4 bu/ac | +15.9% |

| Sask. Harvested Area (Wheat) | 13.5 Million Acres | -4.3% |

Source: Statistics Canada: Production of principal field crops, November 2025

These localized failures mean that while the national “average” looks good, insurance companies are still processing massive claims for farmers who were on the wrong side of the weather divide.

Wildfires, Snowpack, and the 2026 Transition

Heading into 2026, the industry is closely watching the transition to a La Niña weather pattern. Historically, this brings cooler and wetter springs to Western Canada, which could mitigate drought concerns but increases the risk of “unseeded acreage” claims due to flooding.

Furthermore, while 2025 production was high, the risk of wildfire-related “Cat” (Catastrophic) claims remains a permanent fixture of the risk profile. As seen in the Canadian Underwriter’s analysis, even years with decent moisture can be disrupted by early-season heat domes that dry out the ground and trigger wildfire seasons earlier than ever before.

“The 2025 season proved that ‘normal’ weather no longer exists. We saw record yields and record heat stress in the same province. Managing that volatility is the goal for 2026.”

-Agricultural Risk Outlook

Potential Solutions and 2026 Outlook

The rise in crop insurance payouts presents a challenge for both farmers and insurance companies. Farmers face increasing financial insecurity as extreme weather events become more common. Insurance companies, on the other hand, are struggling to keep premiums affordable while managing the rising costs of payouts.

News: SGI CANADA Introduces Farm Credit Score Discount

- Broad Savings: The discount applies to your dwelling, farm buildings, and machinery.

- No Risk to You: This is a “soft hit” that will not affect your credit score. The discount can only lower your rate; it will never increase it.

- Simple Consent: Providing consent to your broker in advance is the fastest way to access these substantial savings at renewal time.

- Full Details: Review more about what this credit score discount entails here ←

This surge in payouts is a clear sign that climate change is affecting Canadian agriculture. With the March 31st deadline for 2026 program changes fast approaching, the off-season is the perfect time to review your crop insurance coverage.

Talk to your advisor, and make sure your policy reflects your needs. By taking charge now, you can ensure your farm is well-protected for whatever 2026 throws your way.

Frequently Asked Questions

Does crop insurance cover losses from heat stress, or just drought?

Crop insurance is a broad safety net. In 2025, many farmers in Eastern Canada saw yields drop due to heat and dry conditions. This type of loss is generally covered, as are losses from pests, flooding, and frost.

If 2025 was a record production year, why are payouts still rising?

While national totals hit records, the weather was highly variable. Record-breaking production in some areas often masks severe losses in others. Insurance pays out based on individual farm yields, meaning a high national average doesn’t reduce the need for payouts in regions hit by heat waves or flooding.

Disclaimer: The information provided in this article is intended as a general guide. Please consult your specific insurance policy for precise coverage details, including conditions, definitions, and exclusions that apply to your individual insurance.

Stay Connected With Harvard Western

Thanks for reading our article; I hope you enjoyed this updated look at how the final 2025 harvest data impacts crop insurance for 2026. Here are some more ways to access more insurance information and tips:

Visit our Blog/article page each month, where we publish various insurance articles and share information on specific industry products.

Learn more about Farm Insurance and visit our product page for comprehensive information.

Follow us on LinkedIn to stay up to date on the latest business insurance articles and follow our company updates.

Posted in Farm on April 19, 2024 by Hope Prost