What is Contractor Pollution Liability Insurance? Coverage Info

A single pollution incident can devastate a contractor’s operations and reputation, with cleanup costs potentially exceeding millions of dollars in Canada. Due to increasingly stringent environmental regulations and media coverage of stories, significantly large pollution lawsuits underscore the necessity of having pollution insurance protection.

Construction projects often encounter unforeseen subsurface risks despite thorough site assessments. In 2007, during the Burnaby crude oil spill, a contractor’s excavator ruptured a Trans Mountain pipeline during sewer trench excavation, resulting in over $15 million in cleanup costs.

Cases like this highlight the critical need for contractors to understand the limitations of standard Commercial General Liability policies, particularly concerning pollution exclusions, and to mitigate potential environmental risks proactively.

The specific insurance limit requirements specified in CCDC 41 (2020) may differ based on the nature and scale of the building project, alongside variables like contractual terms and local laws.

Nonetheless, CCDC 41 (2020) generally specifies the minimum coverage thresholds for various types of insurance typically needed in construction projects:

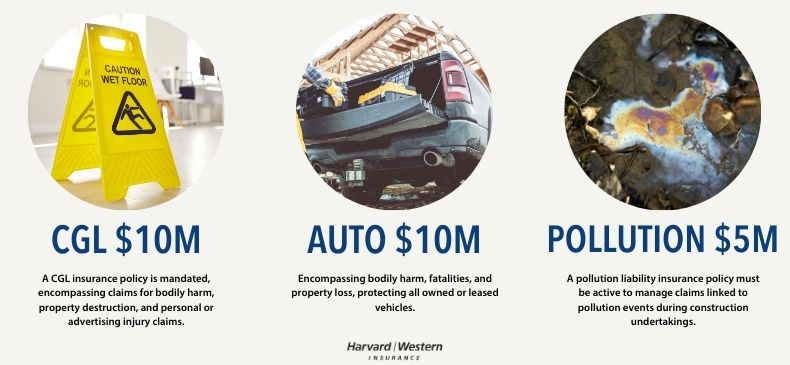

General Commercial Liability (CGL) Insurance – $10,000,000

A CGL insurance policy is mandated, encompassing claims for bodily harm, property destruction, and personal or advertising injury claims.

Vehicle Liability Insurance – $10,000,000

Encompassing bodily harm, fatalities, and property loss, protecting all owned or leased vehicles.

Pollution Liability Insurance – $5,000,000

A pollution liability insurance policy must be active to manage claims linked to pollution events during construction undertakings.

Commercial General Liability policies often exclude pollution-related incidents, leaving contractors exposed to significant risks. Contractors’ Pollution Liability insurance fills this critical coverage gap, protecting against hazardous material releases, soil contamination, and atmospheric pollutants.

What Makes Contractors Pollution Liability Different

Contractor Pollution Liability (CPL) insurance stands apart from standard liability policies through its specialized focus on environmental risks. Unlike traditional coverage options, CPL specifically addresses pollution conditions arising from contracting operations performed by or on behalf of the contractor.

Justin Perry, a national practice leader for the environmental services division, stated,

There’s a belief that you only need environmental insurance for hazardous materials. The reality is environmental insurance responds to a lot more than just chemicals and hazardous materials.

Key Features of CPL Insurance

CPL policies can offer coverage against sudden and gradual pollution events. Furthermore, CPL can sometimes include built-in features such as:

- On-site cleanup

- Emergency remediation costs (gradual form only)

- Civil fines, penalties or assessments

*Please be aware that this compilation is not exhaustive. It is advisable to consult your insurance provider’s documentation consistently for comprehensive information.

How CPL Fills General Liability Coverage Gaps

Standard Commercial General Liability (CGL) policies contain significant exclusions for pollution-related incidents. The fact that 20.4% of liability claims were denied in 2020 shows that some businesses mistakenly believe their general liability policies cover pollution risks. In reality, these policies exclude pollution coverage.

The main exceptions under CGL policies primarily cover smoke from uncontrolled fires or fumes from faulty heating systems. Subsequently, CPL steps in to protect against various environmental exposures, including surface water contamination, chemical spills, and inappropriate disposal of hazardous materials.

CPL policies may also offer additional coverage add-ons for mould and crisis management expenses.

Core Coverage in CPL Insurance

Sudden vs Gradual Pollution Events

CPL policies address both immediate and long-term pollution incidents. Sudden events might involve chemical spills or fuel leaks, whereas gradual pollution occurs over extended periods.

Rather than limiting coverage to immediate discoveries, comprehensive CPL policies protect against pollution conditions that develop slowly.

Contractors should realize,” says Brian Cane, a senior vice president of construction underwriting at ENCON Group, “that most pollution losses occur over a period much longer than 120 or even 240 hours.

Loss Examples of Contractor Pollution Incidents

Example 1: Asbestos Encountered During a Renovation

A contractor was hired to perform demolition/renovation of a building and encountered and disturbed asbestos during the work. The plaintiff alleged that the asbestos was removed negligently, resulting in a dangerous pollution condition, loss of property value, and rental income. Legal action was taken against the contractor.

Example 2: Ductwork Removal and Mold

An electrical contractor removed ductwork from a hospital’s HVAC system, unknowingly spreading a dangerous fungus. The dismantling activities and on-site storage of dismantled ductwork spread the fungus throughout the hospital. Patients became infected, some critically. The contractor was found liable for the spread of the fungus and faced bodily injury and property damage claims exceeding $1 million.

*Coverage is subject to the policy terms, conditions, and exclusions. This document is produced strictly to illustrate where coverage may be afforded by way of example – specific circumstances may alter the availability of coverage.

Contractors Pollution Liability insurance stands as essential protection against environmental risks that standard policies often exclude. Understanding CPL’s unique features can help you make informed coverage decisions.

Environmental regulations continue to grow stricter, making comprehensive pollution coverage crucial for construction businesses. CPL insurance protects not just against immediate incidents but also gradual pollution conditions that may surface years later. This long-term protection, combined with built-in features like emergency response coverage and legal defence costs, provides the comprehensive shield your contracting business needs against environmental risks.

FAQs

What is Contractor Pollution Liability (CPL) insurance? CPL insurance is specialized coverage that protects businesses against claims and exposures resulting from pollution conditions caused by their operations or those of their subcontractors. It covers both sudden and gradual pollution events, filling gaps left by standard general liability policies.

How does CPL insurance differ from general liability insurance? Unlike general liability insurance, CPL specifically addresses environmental risks and pollution-related incidents. It covers areas often excluded by standard policies.

What types of pollution events does CPL insurance cover? CPL insurance covers a wide range of pollution events, including chemical spills, fuel leaks, soil contamination, water pollution, and sometimes mould, depending on the additional coverage.

How much does a Contractor’s Pollution Liability insurance typically cost? The cost of CPL insurance varies based on factors such as business size, location, and risk profile.

Can CPL insurance be purchased for individual projects or as annual coverage? CPL insurance can be obtained as project-specific coverage for individual construction projects or as an annual or multi-year policy, depending on your insurance provider,

Thanks for reading our article; I hope you found this article on contractor pollution insurance helpful. Here are some more ways to access more insurance information and tips:

- Visit our Blog/article page each month, where we publish various insurance articles and share information on specific industry products:

→ Learn more about or get a quote for Contractor Insurance and visit our PRODUCT PAGE ←

2. Follow us on LinkedIn to stay up to date on the latest business insurance articles and follow our company updates:

Posted in Business on April 4, 2025 by Harvard Western Insurance