How Canada’s Climate Changes Affect Business Risk

The 2025 Canadian wildfire season has underscored the growing crisis of extreme weather events. The province of Saskatchewan experienced a record-breaking season, with nearly three million hectares of land burned, the largest amount of any Canadian province this year.

These events confirm that as extreme weather caused by climate change becomes more frequent and intense, understanding the evolving climate landscape in Canada is crucial for business owners and policymakers developing effective risk mitigation approaches.

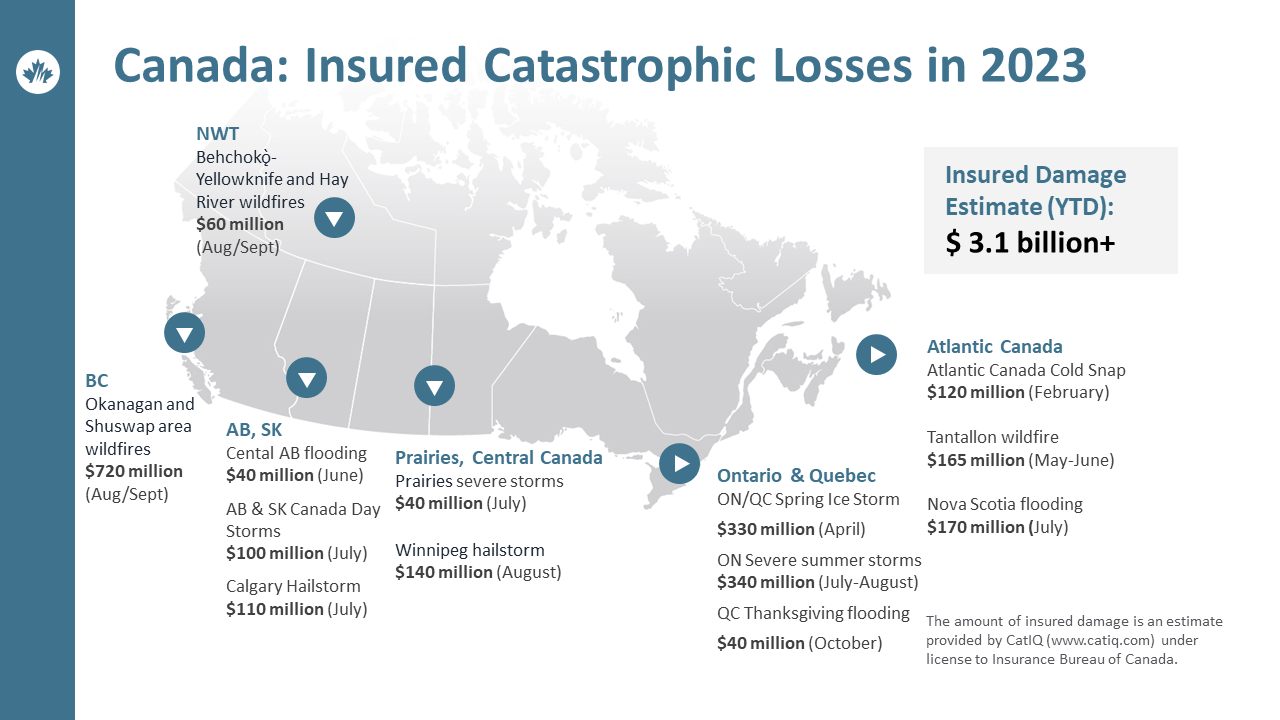

The New Reality of Catastrophic Losses

Increased Frequency of Catastrophic Events

Canada’s climate change has led to a surge in extreme weather events, significantly impacting insurance claims. From 1983 to 2008, insurers paid an average of $400 million annually for catastrophic claims. Since 2009, this figure has skyrocketed to almost $2 billion per year.

This immense scale, driven by a slow-moving high-pressure system and a prolonged period of dry weather, led to multiple fires merging into a single massive complex fire, displacing over 20,000 people since early May.

In financial terms:

According to Catastrophe Indices and Quantification Inc. (CatIQ):

Denare Beach fire insured damage costs

La Ronge fire insurance damage costs

The year 2023 was marked Canada’s worst wildfire season, with devastating fires burning coast to coast:

“By September 5, more than 6,132 fires had torched a staggering 16.5 million hectares of land. To put that in perspective, that’s an area larger than Greece and more than double the 1989 record.”

The 2025 Saskatchewan Wildfire Season

- The Damage: Nearly three million hectares (a massive area) burned across Saskatchewan, the largest burn area in decades for any Canadian province that year.

- The Evacuations: More than 20,000 people had to leave their homes quickly and were displaced.

- The Cause: The fires were fueled by extreme conditions, including a long stretch of very dry weather and a slow-moving, high-pressure system (a “heat dome”) that caused unusually high temperatures.

- The Fire’s Size: Several separate fires grew so rapidly that they merged into one giant fire complex. This huge blaze stretched about 200 kilometres long and 80 kilometres wide.[source]

These events have brought climate change to the forefront for Canadian CEOs, with 75% viewing natural disasters and extreme weather as significant factors affecting prosperity.

Rising Insurance Costs and Coverage Challenges

Insurance Premiums and Cancelled Policies

The financial strain is particularly felt all over Canada, including the province of Saskatchewan. Research conducted by KPMG in Canada reveals that a significant number of Canadian small- and medium-sized businesses (SMBs) have been adversely affected by various natural disasters such as wildfires, storms, floods, and heat domes.

The report highlights worries regarding the increasing financial impact of weather-related calamities, which has led to a rise in the cost of business insurance, posing challenges for many business owners who are finding it difficult to obtain coverage.

While property insurance is foundational, the increasing financial pressures on the industry are becoming obvious

A recent KPMG survey from 2025 highlighted that 49% of Canadian businesses are now reporting that increasing insurance costs are directly impacting their ability to fund investments.

Furthermore, while residential wildfire coverage remains widely available, the risk assessment landscape is changing: the increasing frequency of catastrophic losses means Canada is globally viewed as a higher-risk location for insurers, which directly impacts premiums and long-term affordability for homeowners and businesses alike.

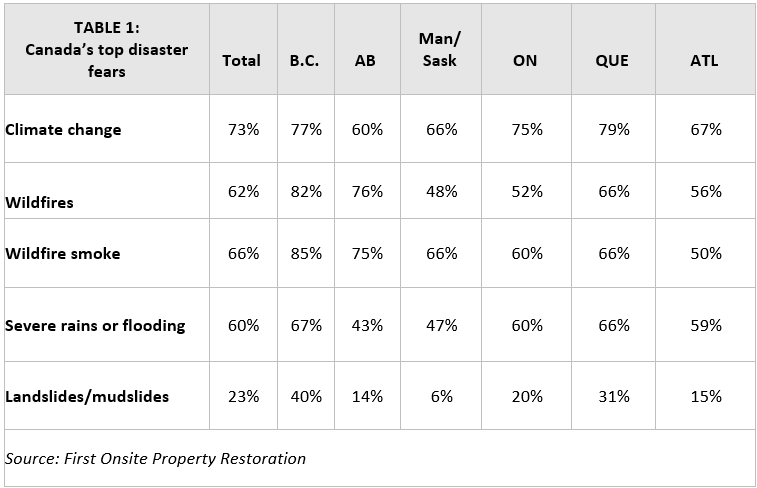

FIRST ONSITE has commissioned a Weather and Property Survey, which delves into Canada’s foremost apprehensions regarding disasters.

See the image below for the results of Canada’s top disaster and severe weather fears.

“We conduct this survey every year to get a benchmark of Canadian attitudes, weather worries, and concerns that businesses and homeowners have for their properties…People are aware that storms aren’t acting like they used to, and we are seeing an increase in all types of property damage from weather events.”

Supply Chain & Economic Ripple Effects (Consolidated)

Financial Impacts & Operational Resilience

Shipping companies in Canada know the weather challenges they face when operating in a vast country that spans nearly 10 million square kilometres, from the Pacific to the Arctic to the Atlantic. This includes both the immediate effects of short-term weather events, such as road closures and the shutdown of local supply chains, and the more significant impact of severe weather events that result in the destruction of supply warehouses and infrastructure.

The primary track of the Canadian National (CN) Rail in Jasper, which was temporarily stopped due to wildfires, has now recommenced its operations. Nevertheless, both CN Rail and Canadian Pacific Kansas City Limited (CPKC) rail systems still face the looming threat of wildfires. This persistent risk presents a potential obstacle for retailers who depend on these rail networks to transport their products.

This disruption risk is directly measurable: a September 2025 KPMG poll found that two-thirds of businesses now cite climate change as the biggest risk to their supply chains. This indicates an elevated and sustained threat to inventory and operational stability.

“Until about five years ago, disasters happened periodically, maybe every few years. Now, they’re really occurring every year,”

The ongoing wildfires and flooding problems in Canada present a constant threat that could potentially challenge retailers in terms of inventory management and product availability.

KPMG 2024 Survey Report on Canadian Business Leaders

Encountered supply chain disruptions

Canadian Business Profitability Hits

Climate issues are starting to slow down Canada’s economic growth overall. The Canadian Climate Institute estimated that these climate impacts will cost the country around $25 billion every year starting in 2025. This huge number is equal to half of all the economic growth Canada is expected to see in that year alone.

More directly, this rising financial pressure is having a significant impact on homeowners. A recent study showed a clear link between wildfire danger, rising home insurance costs, and the affordability of mortgages.

While the average cost of insurance stayed steady across the country at about 2% of the monthly mortgage payment, this national average hides a **serious affordability crisis in areas most exposed to wildfires**. The regions feeling the strongest financial strain are Alberta and British Columbia. In specific markets, like Medicine Hat, the percentage of a homeowner’s monthly payment going to insurance has jumped dramatically.

This clearly shows that climate change is no longer just a distant natural disaster problem; it has become a direct affordability issue for homeowners. The report warns that if insurance costs continue to rise, it will likely start dictating where younger buyers can actually afford to purchase a home.

“The extreme weather events of the last couple of years have driven home the cost of climate change to the Canadian economy and the bottom line of individual businesses… devastating forest fires, floods, hurricanes, and extreme heat have impacted profitability for more than half of Canadian companies. Even those that escaped damage fear they will be hit this year – with over two-thirds being very or extremely concerned.”

Building Resilience & Proactive Strategies

Government & Industry Response

Since the threat of wildfires has grown significantly, Canadians need both governments and the private sector to continue putting money and effort into finding joint solutions.

To specifically address the rising financial losses from wildfires, the federal government, alongside provinces like Saskatchewan, has announced major investments.

- A combined $104-million investment was announced for the Resilient Communities through FireSmart (RCF) Program. The RCF provides funding to enhance wildland fire prevention and mitigation efforts.

- The Government of Saskatchewan announced a joint investment of over $44.8 million over five years in the RCF and the Fighting and Managing Wildfires in a Changing Climate Program Equipment Fund. The FMWCC supports strengthening wildland fire management capabilities by procuring specialized firefighting equipment.

Prioritizing Community Protection

Across the country, leaders at all levels must make protecting people and communities their top priority. This requires several key actions:

- Modernize Building Codes: Update construction rules to require fire-resistant materials (like tough roofing and siding) in all new buildings.

- Empower Local Planning: Help communities develop and execute their own specific wildfire preparedness plans.

- Incentivize Resilience: Offer rebates and retrofit programs to encourage homeowners and businesses to upgrade existing properties, making them stronger against fire.

- Use Natural Firebreaks: Prioritize nature-based solutions, such as controlled burns, smarter forestry, and planting green firebreaks in agricultural areas.

- Establish a Federal Agency: Create a dedicated National Emergency Management Agency to improve preparedness, recovery coordination, and data sharing across all jurisdictions.

Vulnerability Analysis of Assets and Operations

It is crucial to assess the vulnerability of your assets and operations to climate-related threats.

- Identify vulnerabilities: Pinpoint assets and operations most susceptible to climate-related risks (e.g., flooding, wildfires, extreme heat).

- Quantify potential losses: Estimate financial impacts of various climate scenarios to inform insurance coverage needs.

Risk Management Planning with Insurance

To address the emerging climate risks, it is advisable to broaden your insurance coverage by considering additional options suchp as:

1. Business Interruption Insurance

Coverage: Covers lost income and ongoing expenses when a business is unable to operate due to a covered peril, such as a natural disaster.

Climate Relevance: Protects against losses from events like hurricanes, floods, wildfires, and extreme weather that can disrupt operations.

2. Flood Insurance

Coverage: Specifically designed to protect against losses caused by flooding. While often federally backed in some countries, private flood insurance options are also available.

Climate Relevance: Essential for businesses located in flood-prone areas or those at risk of rising water levels.

3. Cyber Insurance

Coverage: Protects businesses from financial losses from cyberattacks, including data breaches, system failures, and business interruption.

Climate Relevance: Although not directly related to weather, during a crisis caused by a climate event, certain systems may face increased vulnerability to cyberattacks due to the shift in focus and allocation of resources.

FAQs

How is climate change impacting Canadian businesses?

Climate change leads to extreme weather events, such as major windstorms, that can delay the transportation of goods and resources, potentially causing significant disruptions in business operations and affecting earnings.

What business risks are associated with climate change?

Climate change introduces chronic risks stemming from long-term shifts in climatic patterns, such as increased temperatures and altered rainfall patterns. These changes can lead to sea level rise and more frequent heatwaves and pose physical risks, including asset damage and supply chain disruptions.

In what ways does climate change influence business management in Canada?

The unpredictability of weather due to climate change can directly impact businesses by increasing the likelihood of water shortages or flooding. This unpredictability makes it challenging to secure insurance and necessitates that businesses develop strategies to mitigate these risks, such as flood protection measures.

Disclaimer: The statistics and news videos referenced in this article are based on publicly available information.

Stay Connected With Harvard Western

Thanks for reading our article; I hope you enjoyed this month’s topic on how climate change is affecting insurance here in Saskatchewan. Here are some more ways to access more insurance information and tips:

Visit our Blog/article page each month, where we publish various insurance articles and share information on specific industry products.

Learn more about or get a quote for Business Insurance, and visit our product page for comprehensive information.

Follow us on LinkedIn to stay up to date on the latest business insurance articles and follow our company updates.

Last updated:

Posted in Business on August 13, 2024 by Hope Prost